If You're Stuck in the Market – Can't Average, Can't Exit – This Is Your Story

Introduction: The Emotional Trap of Every Nepali Trader

Have you ever made small profits in the beginning, only to get stuck in the stock market later — unable to average down, unable to exit with dignity? If so, you’re not alone. This is your story. This is the story of Ram, a trader like thousands of us, who got caught in the emotional rollercoaster of the Nepali stock market (NEPSE).

Ram’s Trading Journey: From IPO Excitement to Profitable Start

Like many new investors, Ram’s journey began with IPOs. He applied for every public offering, celebrated even the smallest allotment, and saw quick profits as those stocks debuted in the secondary market. The market was bullish. NEPSE was rising. Green numbers gave him confidence. He felt like a smart investor — even a future millionaire.

He reinvested his early profits without much research. His friends were doing it. YouTube channels were hyping hydropower stocks. Everyone said, "Buy now or regret later."

So Ram started scanning MeroShare. He sorted by lowest LTP and highest public shareholding, thinking that cheap stocks and popular names must be safe bets. He didn’t look at company profits, fundamentals, or sector performance. He just followed the crowd.

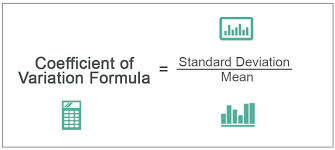

Mistake #1: Confusing Cheap Price with Good Value

Ram bought shares priced under Rs. 100 thinking, “These are undervalued. They’ll double soon.” But he didn’t realize that cheap stocks are often cheap for a reason — lack of profit, poor management, or low growth.

This is a common trap. New traders often chase low-priced shares assuming they are deals. But price alone is not value.

Mistake #2: Overconfidence After Initial Gains

Encouraged by early profits, Ram increased his capital. He even borrowed money from friends and family to buy more stocks. But he didn’t set a stop loss. He had no plan. His strategy? Hope.

He ignored basic rules like risk management, diversification, and research.

Mistake #3: No Exit Plan and No Backup for Averaging

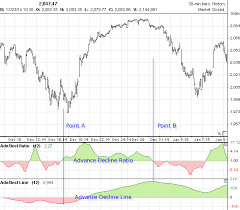

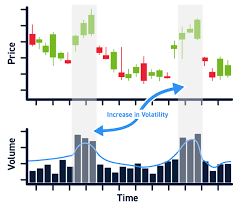

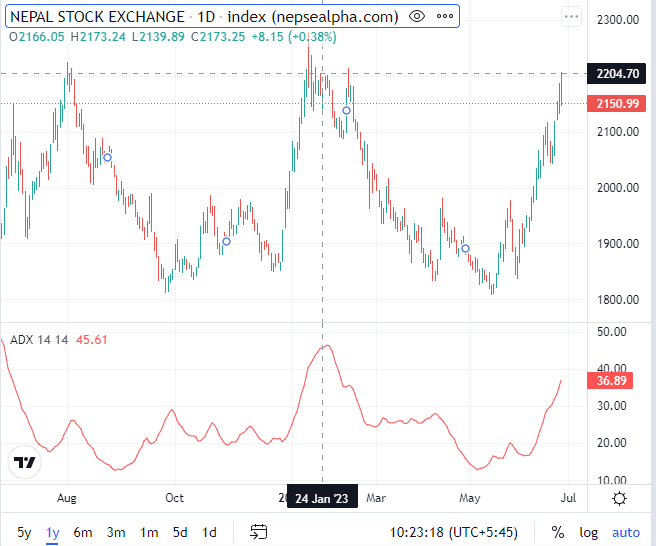

Then came the correction.

NEPSE started to drop — slowly at first, then suddenly. Ram’s portfolio turned red. Every day he refreshed his dashboard hoping for a rebound. But the stocks kept falling. He had no cash left to average down. And he couldn’t exit, because every sale would lock in a huge loss.

Ram was stuck.

This is where most traders give up, or worse, throw in more money emotionally and lose even more.

Lessons Ram Learned (The Hard Way)

After facing heavy losses, Ram stopped and reflected. He realized:

-

He followed hype, not homework.

-

He chased the crowd, not the company’s fundamentals.

-

He risked too much without a plan.

-

He didn’t diversify. All his money was in hydropower.

-

He had no stop-loss, no exit strategy.

He wasn’t trading. He was gambling.

The Turnaround: Smart Habits Every Trader Must Build

Ram didn’t quit. He decided to learn.

He started reading financial reports and stock analysis.

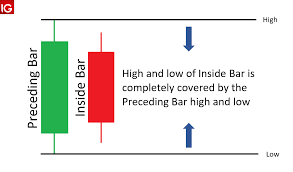

He set manual stop-loss levels to control damage.

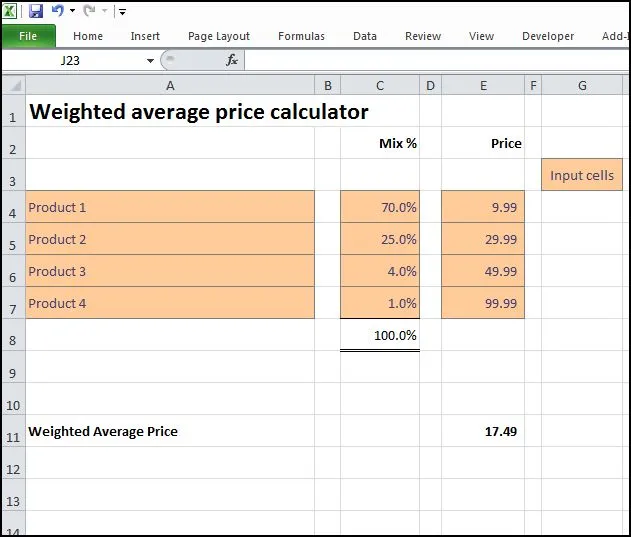

He diversified: invested in banks, mutual funds, and insurance.

He built a trading journal to track every entry and exit.

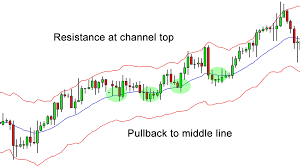

He stopped watching tips and started following strategy.

Now, he trades with patience, not pressure. Each trade is backed by logic, not emotion.

Final Words: This Is Every Nepali Trader’s Story

Ram could be anyone. Ram is me, you, and everyone who enters the market thinking it's easy money.

But trading isn’t about being right every time. It’s about protecting your capital, learning from mistakes, and growing slowly.

If you're stuck in the market — if you can't average, can't exit — don't give up. Start again with a plan. Learn what Ram learned the hard way.

Key Takeaways for Every Nepali Trader

-

Don’t chase cheap stocks – understand value, not just price.

-

Never invest without a plan – always know your exit points.

-

Set stop-loss rules manually – NEPSE won’t do it for you.

-

Diversify your portfolio – don’t bet everything on one sector.

-

Control your emotions – greed and fear are your biggest enemies.

Want More Real Stories Like This?

Subscribe to our YouTube channel SmartKarobaar for more honest stories, analysis, and practical trading education for Nepali investors.

https://www.youtube.com/@smartkarobaar1594

Empower your trading journey — one smart decision at a time.